At its recent meeting, the Federal Open Market Committee (FOMC), as expected, left the federal funds rate near the zero bound and affirmed its plan to continue with asset purchases at current levels. The Summary of Economic Projections (SEP) reflected increased optimism related to economic activity and labor market improvement.

However, the Fed stressed that the road to recovery is a long one. Rising Treasury yields amid higher inflation expectations called into question whether the Fed should tighten policy sooner than anticipated. Powell firmly stated that the FOMC is not close to thinking about raising rates or tapering asset purchases. The well-telegraphed Fed announcement last week was generally supportive for U.S. markets with most major fixed income and equity indices advancing on the news.

Here are highlights from the meeting and the market’s reaction.

Fed Decision and Summary of Economic Projections

The FOMC voted unanimously to leave rates unchanged with the federal funds target range remaining at 0% - 0.25%. Additionally, the Fed will continue purchasing $120 billion of Treasuries and Agency Mortgage-Backed Securities (MBS) each month.

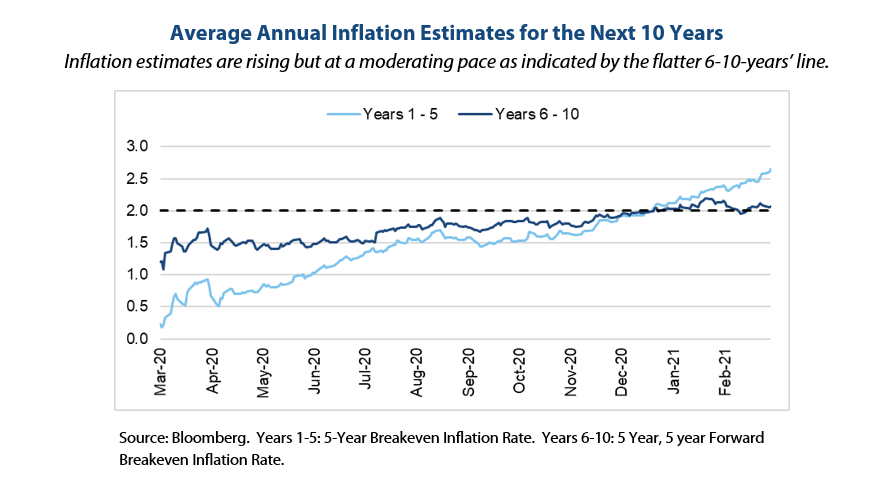

Despite rising inflation expectations, the Fed reiterated its intention to achieve inflation “moderately above 2% for some time,” suggesting that monetary policy will remain accommodative in the coming quarters as vaccination efforts continue and economic activity begins to normalize.

Updated economic predictions from Fed members, which include expectations for rate hikes (i.e., the Fed dot plot) indicated that four members (up from one last quarter) expect a hike in 2022 and seven (up from five last quarter) expect one in 2023.

While the policy stance remains dovish, there were hints of optimism in some of the forecasts. In particular, the 2021 GDP estimate was revised higher to 6.5% versus 4.2% in the December release.

Powell Press Conference Notes

In his post-meeting press conference, Fed Chair Jerome Powell emphasized the elevated uncertainty that remains, noting that we have never navigated out of a global pandemic on this scale. Economic data is improving, but vaccine progress and containment of the virus continue to be critical factors to the success of economic recovery.

Regarding inflation, Powell hinted at the potential transitory nature of the recent run-up in prices and underscored that the Fed’s 2% mandate is a long-term target. Short-term increases likely will not have immediate and direct implications on the Fed’s policy decisions. The pandemic-induced shutdowns that began about a year ago suppressed inflation for months, so it is logical to expect and see an uptick in those prints amid, and in anticipation of, more reopening measures.

Powell declined to respond to a question about the supplementary leverage ratio (SLR) and disclosed that a Fed announcement specific to this topic will be shared in the coming days.

Market Reaction

Interest rates rallied modestly into the market close following the Fed’s March 17 decision. The 10-year and 30-year Treasury yields fell a couple basis points to 1.65% and 2.42%, respectively. For reference, the 10- and 30-year yields started 2021 at 0.91% and 1.64%.

Broadly speaking, equity prices also moved higher on the news of continued accommodative monetary policy, which comes on the heels of a massive fiscal stimulus package. The Dow Jones Industrial Average (the Dow), a proxy for large U.S. blue-chip companies, set another all-time high record, breaking 33,000.

The FOMC said it would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the committee’s goals. Any assessment would consider information including public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

The committee is scheduled to meet again April 27-28.

If you would like more information, please contact an advisor at Fi3.