Research to help you reach your financial goals.

At Fi3 Financial Advisors, we are committed to providing timely and well-researched financial and investment guidance to our clients so that they can make more empowered financial decisions. These featured resources often are used to help guide our conversations.

2024 Financial Planning Guide

Our 2024 Financial Planning Guide shares current information on areas including:

Tax planning.

Retirement planning.

Estate planning.

Education planning.

Risk management.

Long-term care.

2023 Review & 2024 Outlook Video

Listen to Bob Schaefer, Senior Director of Investments, talk about the review of the 2023 market and what 2024 currently looks like.

2023 Portfolio Rebalancing

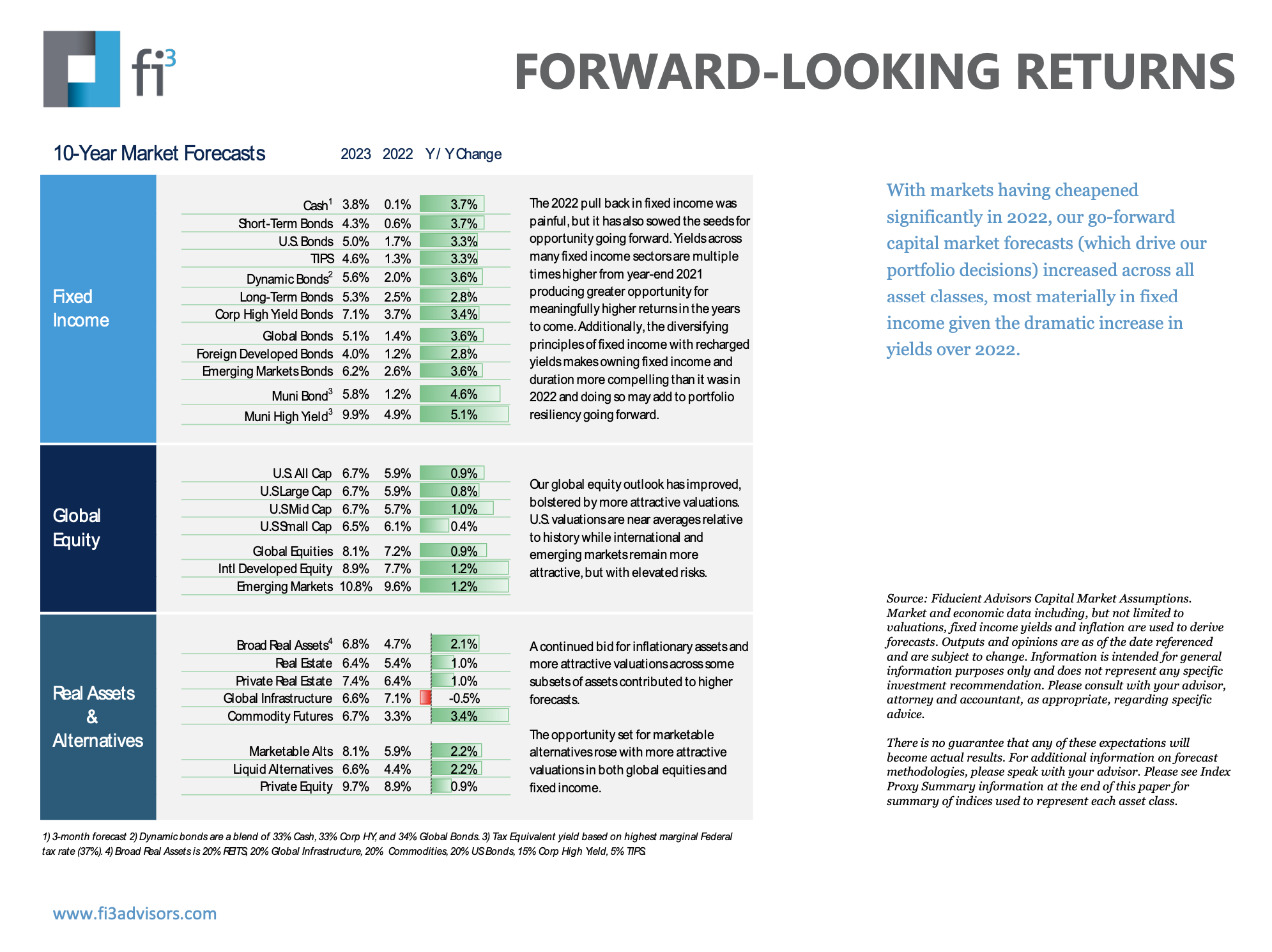

With markets having cheapened significantly in 2022, Fi3's go-forward capital market forecasts (which drive our portfolio decisions) increased across all asset classes, most materially in fixed income given the dramatic increase in yields over 2022.

2023 Financial Planning Guide

Our 2023 Financial Planning Guide shares current information on areas including:

Tax planning.

Retirement planning.

Estate planning.

Education planning.

Risk management.

Long-term care.

2023 Market Outlook

Opportunity is forecasted to grow in 2023, even with the continued uncertainty the markets have experienced in recent years. With capital marketing forecasts increasing across all asset classes (most materially in fixed income,) our outlook features three key investment themes for the new year:

Persisting volatility

Moderating inflation

Bear market bottom

2022 Market in Review

High inflation was the theme of 2022, ushering in the Fed’s hikes to calm recessionary fears and navigate geopolitical risks. This volatility is anticipated to persist in 2023 and could spell a permanent departure from a decade-long period of general market stability. However, analysts expect we are closer to the end of the bear market rather than at the beginning of the cycle.

2022 Financial Planning Guide

Our 2022 Financial Planning Guide shares current information on areas including:

Tax planning.

Retirement planning.

Estate planning.

Education planning.

Risk management.

Long-term care.

2022 Market Outlook

Since the onset of the pandemic in March 2020, uncertainty related to the coronavirus and its new variants have been the primary source of downside volatility in equity markets. We outline our perspective on the 2022 Market Outlook. The Market Outlook includes:

Financial market conditions.

A look at 10-year capital market assumptions.

Investment themes for 2022.

Updated 10-Year Capital Market Forecasts

Our firm updates asset class assumptions annually to reflect 10-year estimates for:

Asset class returns.

Standard deviations.

Skewness.

Kurtosis.

Correlations.

2021 Market Outlook

In our 2020 Market Outlook, we wondered what could possibly derail the markets, which experienced a remarkable year in 2019. We found out that answer is early 2020 - COVID-19. We believe the global economy is poised to achieve strong year-over-year growth and modest inflationary pressures in the first half of 2021, which should benefit risk assets and spread sectors.