There Is No Such Thing As Passive Asset Allocation

Passive investments continue to gain market share within the construction of investors’ portfolios. The success of passive investing has also attracted investors with passive portfolio construction. As passive allocations rise, it is important to know how passive indexes are constructed. However, in our opinion, there is no such thing as passive asset allocation. It is our view passive investors overlook key elements of asset allocation, most notably, index methodology.

The goal of a passive portfolio is to gain exposure within a targeted market. However, the definition of “the market” is not consistent. For example, take U.S. Large Cap Equity Portfolio. Is the Standard & Poor’s 500 the definitive measure for large equity? If so, how does S&P’s committee-based approach compare to the Russell’s count-based or the Center for Research in Security Prices (CRSP) cumulative market cap-based methodologies?

For investors, the differences in methodologies can create implementation issues.

The S&P 500 is used by investors to boost exposure to large-cap equities. Instead of pairing the S&P 500 with S&P’s mid or small-cap indexes that have the same methodology, the small-cap complement is the Russell 2000 Index. The Russell 2000 includes the smallest 2000 companies in the Russell 3000 Index. The two indices are routinely paired in various allocations (80/20, 75/25, 70/30), to capture most of the U.S. market. Investors, however, are most likely unware they have systematically underweighted mid-cap equities by commingling the methodologies.

This graphic highlights the variation in small-cap definitions by the large index providers.

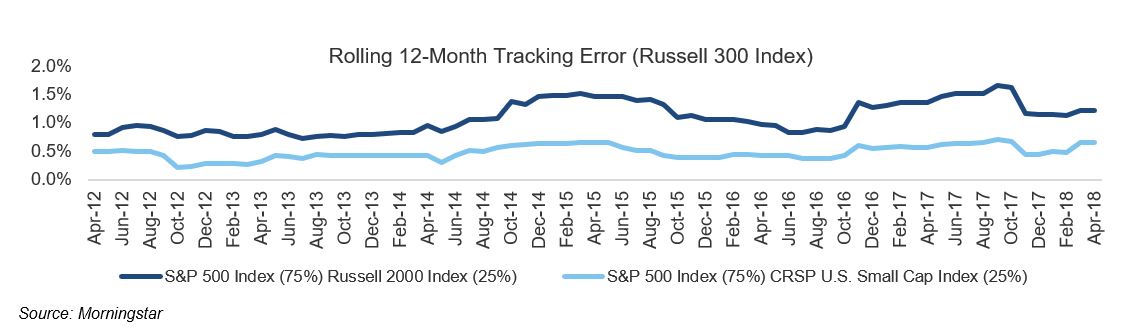

The ramification of incongruous index construction goes far beyond consensus. Any discrepancy in the methodology translates to a deviation in return and risk. This omission, during portfolio construction, can cause investors to allocate funds from providers to indexes that don’t have a complementary offering across tracked indices.

Note, the difference in methodology is more than academic. Within a calendar year, as illustrated in the chart above, the variation in return was 8.3 percent. Also, if the goal is to track the full market (i.e. all capitalizations), combining the methodologies can diminish the investor’s objectives.

To engage passive investments within a portfolio has merit. However, it is our opinion that investors should not take a passive approach when it comes to asset allocation. Thoughtful portfolio construction is important to success. Mixing and matching differing index providers can have a negative impact. The decision regarding which indices to use and how to rebalance needs to be an active one. If not, investors may be exposed to unforeseen risks.

Please feel free to contact any of our advisors if you have any questions.

While this article addresses generally held investment philosophies of Fi3 Advisors, it does not represent a specific investment recommendation for any individual client or prospective client. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Information has been obtained from a variety of sources believed to be reliable but not independently verified. Past performance does not indicate future performance.