Emerging markets have been met with volatility for much of 2018 as a confluence of events have resulted in losses for both equity and fixed income investors. Much of the volatility in the broader space has been driven by events and occurrences domestically. A strengthening U.S. dollar has been a notable negative for investments overseas, but particularly for those countries with an outsized portion of U.S. dollar-denominated debt. In addition, trade negotiations have increased uncertainty over the future and outlook of global trade, particularly with China.

Historically, emerging markets have shown more volatility than developed markets, something we expect to continue. We believe, however, investors who remain in emerging markets should be compensated for this risk over time as current valuations are more attractive as compared to developed markets.

Where do we stand today in emerging markets?

Emerging markets have experienced a volatile 2018, entering bear market territory (defined as a 20% drawdown from peak level) after falling 25% between late January and the end of October. The decline is familiar to investors who experienced the 35% decline that culminated in January 2016 following concerns of liquidity and economic growth in China. Since then, China has been a major bright spot in the market as they have taken steps to further open investment for foreign capital.

Instead of heartburn emanating from the Chinese markets, concerns around Brazil, Turkey, and Argentina have coupled with a stronger U.S. dollar to cast a shadow over the entirety of emerging markets. Investors in emerging markets debt have not felt any better during the first 10 months of this year as those bonds had fallen 9.9% through the end of October. [1]

Making matters worse, the underperformance comes when domestic equities have outperformed nearly every other asset class. If only investors had bought the S&P 500, they would have earned a positive 3.0% instead of seeing themselves down 15.7% through the end of October 2018, as was the case with the MSCI Emerging Market Index.

What have been the main reasons for the selloff?

It is difficult to point to a single event this year that caused the decline in emerging markets. It was a confluence of events, ranging from a stronger U.S. dollar to fiscal and currency crises in individual countries that resulted in the flight of capital. A tendency of investors who are approaching this market is to lump all emerging markets into the same basket. Although the emerging markets’ economies are developing, their respective growth drivers and pain points can be very different.

The rise of passive investing in this market has put extra strain on the view that “what is bad for one is bad for all.” This is patently false, yet frequently causes undue volatility. It is among the many reasons we recommend an active approach within emerging markets.

How does global trade effect emerging markets’ economies?

Between 1990 and 1994, global trade between developed economies was 63% of total trade. Fast forward two decades to the period 2010 – 2015, and emerging economies were involved in 62% of all goods traded.[2]

This monumental shift in trading patterns was a significant driver in the growth of emerging markets who exported their resources (historically cheaper labor and natural resources) to more developed parts of the world.

Generally, trade is good for global growth and boils down to two key macroeconomic concepts that are the basis for international trade: specialization and comparative advantage. Specialization is simple – focus on producing what you are good at and trade for what you are not. Comparative advantage allows all manufacturers to produce at a point that maximizes profit.

These principles allow economies to produce and trade in a fashion maximizing overall utility across the globe. The economic theory, of course, assumes trade is free – an assumption that has been put to the test against protectionist rhetoric for much of this year.

What is the impact of tariffs?

A hot topic for much of 2018 has been the effect of tariffs on global trade and the protectionist stance taken by the Trump administration. Sparing a second economics refresher, tariffs are a negative for trade. While increasing government revenue can be a positive for current accounts, the tension it creates can be negative. The issue stems not only from the fact that goods and services become more expensive, but also the potential for deteriorating diplomatic solutions.

How do crises in Turkey and Argentina affect investments in emerging markets?

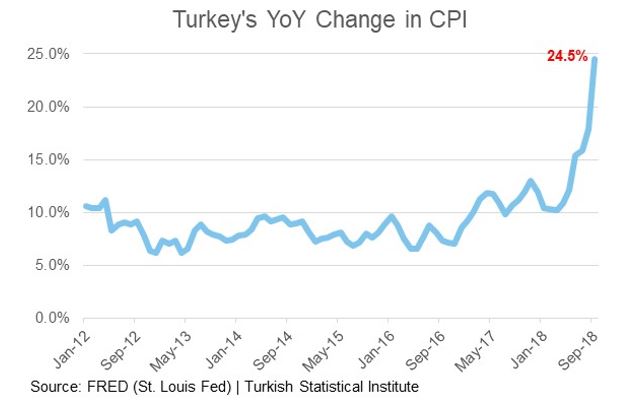

There have been significant headlines surrounding ongoing crises in Turkey and Argentina. Alone, the impact of these on the entirety of emerging markets is almost negligible. Turkey makes up just 0.61% of the index, and Argentina is not in the index. This corroborates our earlier point – the extrapolation of one country’s problems is not emblematic of them all. The economic rough patch in Turkey was exacerbated by policy decisions by the country’s president, Recep Tayyip Erdogan; that led to a sharp decline in the Turkish Lira which in turn put pressure on debt issues by the company, particularly debt issued by the country, particularly debt issued in U.S. dollars.

To make matters worse, inflation has taken control, climbing for six consecutive months to nearly 25% (year over year, as of September 30). The way central banks typically fight inflation – raising interest rates – hurts economic growth.

A similar story has concurrently unfolded in Argentina, where the currency began depreciating against the U.S. dollar made debt denominated in U.S. dollars more expensive. A recently issued $50 billion loan from the IMF helped temporarily, but inflation rates over 30% and depleting foreign currency reserves has put the country in a difficult spot. Nonetheless, the overall impact to broader emerging markets has certainly been felt to a greater degree than Turkey’s (0.61%) and Argentina’s (0.00%) weight in the MSCI EM Index suggests.

An obvious concern is contagion into other areas; however, there has been little evidence of this. Given the geographic distance, little trade occurs between Argentina and Turkey and emerging Asia. In developed markets, Spanish banks are the most exposed to Turkey with roughly €81 billion in exposure according to IHS Markit while French banks have €35 billion in exposure. These exposures suggest the risks of contagion are low.

What impact does the dollar have on these markets?

Since early 2008, the U.S. dollar has strengthened by 42% against a broad basket of developed market currencies; its longest and largest period of appreciation since June 1995 when the U.S. dollar had a similar run, strengthening 39% over a period of six years. The table, below, shows the year-to-date depreciation of notable emerging markets economies versus the U.S. dollar. The impact is two-fold. Not only does an appreciating U.S. dollar offset local dollar returns when converted back to U.S. dollars, it can be troublesome for countries who have borrowed in U.S. dollars.

For example, if a country borrows $100 million and the exchange rate is 2.0 (2 units of local currency = 1 USD) and the local currency subsequently depreciates 5% against the U.S. dollar, it now takes 210 million units of the local currency to repay the debt. This can quickly become problematic, particularly for the likes of countries that see sharp and unrelenting declines in their currency.

Why is the U.S. dollar strengthening and will it persist?

The strength of the U.S. dollar can largely be attributed to demand for U.S. denominated assets – namely bonds. With nominal yields in other developed markets such as Japan and core Europe so low, droves of investors have come in to scoop up U.S. dollar denominated debt. This investor movement forces the sale of another currency and the purchase of U.S. dollars – causing demand to outstrip supply.

A 2014 “taper tantrum” followed by a sharp strengthening in the U.S. dollar sent interest rates higher as the United States signaled tightening when most every other country around the world was loosening their monetary policy. Further, as U.S. dollar-denominated debt becomes more expensive, in local currency, there is a frantic effort to increase foreign currency reserves or swap foreign currency for U.S. dollars in the open market, adding to demand and a continuance of the U.S. dollar momentum. However, we believe that the strength seen for the past decade is unlikely to persist as peers continue to shift their monetary policy directionally in-line with the Federal Reserve.

What are key risks for further pressure on emerging markets?

While emerging markets have seen significant pressure thus far, there are some obvious concerns that could lead to continued or further pressure. Sustained strength in the U.S. dollar is a primary risk and one that we have seen the dark side of.

Among the other key risks, we must highlight concerns around growth in China given its weight in the benchmark and frequent use as a proxy for emerging markets. One final risk to highlight are the idiosyncratic crises that have the perception of contagion. These issues can be deepened by non-traditional policy decisions by emerging markets’ central banks, particularly when paired with a high level of U.S. dollar denominated debts.

Outlook

While emerging markets have undergone an extended bout of underperformance relative to developed markets, namely the United States, the thesis to continue allocating to the asset class remains. Emerging markets have and are expected to carry higher relative risk for investors. In return, we expect investors will be compensated with long-term returns that outpace developed markets.

The last point in the calculus is valuation of emerging markets relative to developed markets, specifically domestic. Currently, companies within the MSCI Emerging Markets Index have a weighted average price-to-earnings ratio of 13.0x. This is below the 10-year average ratio of 14.0x and sits significantly below where the S&P 500 currently stands at 21.0x.[3]

In addition, over the next three years, the World Bank expects growth from developing economies to be more than 2.0x greater than that of advanced economies. Forward looking, we view the combination of growth expectations at current valuations to be very attractive. While diversification hasn’t paid off for much of this year, the value proposition presented by emerging markets is hard to ignore if investors extend their time horizon and consider the opportunity over the next three, five, or 10 years. Ultimately, we believe continued allocations will help investors achieve their goals.

Do you have questions about the impact of emerging markets on your portfolio? Contact an advisor at Fi3 today.

Disclosure: While this article addresses generally held investment philosophies of Fi3 Advisors, it does not represent a specific investment recommendation for any individual client or prospective client. Please consult with your advisor, attorney and accountant, as appropriate, regarding specific advice. Information has been obtained from a variety of sources believed to be reliable but not independently verified. Past performance does not indicate future performance.

[1] Bloomberg, as of 9/30/2018

[2] Martin Currie

[3] Measured by the JPM GBI-EM Global Diversified Total Return Index